40 a bond's coupon rate

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... Difference Between Coupon Rate and Required Return The coupon rate is not calculated on the market value. Instead, it is calculated on the bond's face value. For example, if you have a 5 year Rs 1000 bond that has a coupon rate of 10 per cent, then irrespective of the market value of the bond price, you will receive Rs 100 every year for five years.

Bond Yield: Definition & Calculation with Interest Rates A coupon rate of 5% A maturity date of 10 years Every year, the bond pays $50 in interest. Now, suppose interest rates on new $1,000-bonds rise to 7.5%. If an investor wants to sell this bond...

A bond's coupon rate

Coupon Types - Financial Edge Training The coupon formula is 3-Month Libor + 1.2% (i.e. 2.68% + 1.2% = 3.88%). The coupon rate (3.88%) is given by the coupon formula - with quarterly interest payments. Assume that LIBOR has been fixed at 2.68%. The next coupon payment, assuming that LIBOR has been fixed at the aforesaid rate, is computed below (US$970,000). Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

A bond's coupon rate. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Fixing of coupon rates - Nykredit Realkredit A/S Bonds with quarterly interest rate fixing The new coupon rates will apply from 7 July 2022 to 7 October 2022: Uncapped bonds NO0010887391, (SNP), maturity in 2025, new rate as at 7 July 2022: 2 ... Fixing of coupon rates - Nykredit Realkredit A/S Fixing of coupon rates effective from 7 July 2022 Effective from 7 July 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly... WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100 Let's understand couponrate calculation with the help of an example. BONDS | BOND MARKET | PRICES | RATES | Markets Insider U.S. Rates 3 Months: 1.64 -2.95%-0.05: ... The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. The issuer of the bond ... How Changes in Economic Growth Affects Bonds - The Balance Interest Rate Risk . Interest rate risk means that bond returns vary based on the amount of fluctuation in interest rates. The amount of risk added to a bond through interest rate changes depends on a few factors: how much time until the bond matures, the bond's coupon rate, or its annual interest payment. Basics Of Bonds - Maturity, Coupons And Yield A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually.

Bond Key Terms (With Types and Methods of Investing) The coupon rate of a bond is a fixed interest rate that bond issuers pay out to bond owners. For example, if a bond has a face value of $4000 and a coupon rate of 5% payable annually, then the bond issuer is promising to pay the bond owner $200 each year until the bond matures. Coupon Rate ( nominal yield) : Learn, how The coupon rate affect the ... A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more desirable for investors ... Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Fixing of coupon rates - Nykredit Realkredit A/S - 05.07.2022 Effective from 7 July 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly interest rate fixing. The new coupon rates will apply ...

Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,...

Bond Yield: Definition, Formula, Understanding How They Work The coupon yield — or coupon rate — is the interest you earn annually from a bond. For example, if you bought a bond for $100 and earned $5 in interest per year, that bond would have a 5% ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership.

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually.

Brezik: Rising interest rates and bonds | Columns | trib.com The coupon rate is the stated rate on the bond and is based on its par value. For example, if you purchase a $10,000 par value bond with a coupon of 5%, you will receive annual interest of $500 ...

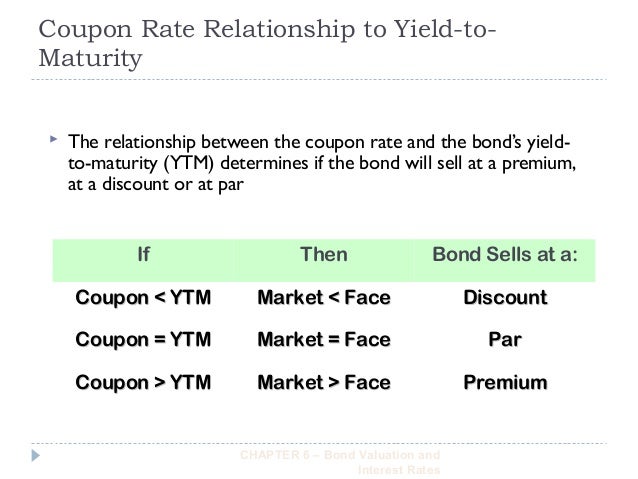

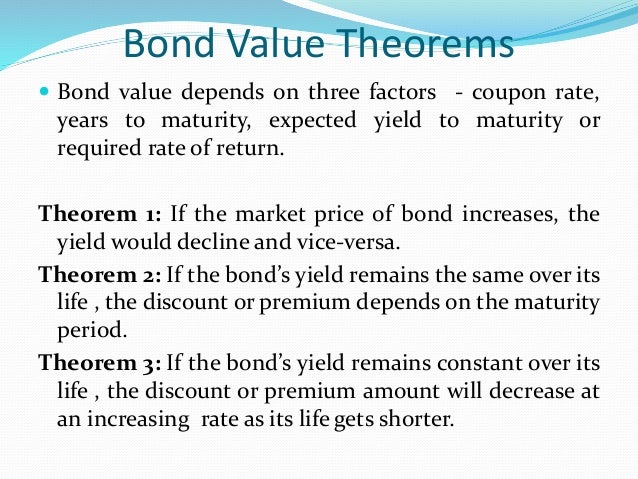

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Premium vs Discount Bonds: Which Should You Buy? - SmartAsset This means the coupon rate for the bond has fallen below wherever market rates are currently. Discount bonds can be attractive to investors who want to purchase bonds at a lower price. The discount price can help to offset lower yields associated with the bond. The deeper the discount, the higher the potential for gains from these bonds.

Coupon Rate Calculator | Bond Coupon For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

Post a Comment for "40 a bond's coupon rate"