43 coupon rate of bond

What is Coupon Rate? Definition of Coupon Rate, Coupon ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Difference Between Coupon Rate and Required Return (With ... Coupon Rate vs Required Return. The main difference between Coupon Rate and Required Return is that coupon rate is the constant value paid by the bond issuer at regular intervals until the bond matures, whereas required return is the amount accepted by the investor for assuming the responsibility of the stock and as an amount of compensation.

Coupon Rate of a Bond - Harbourfront Technologies Coupon Rate of a Bond = Total Annual Coupon Payment / Par Value of Bond x 100% For example, a bond offers a total annual coupon payment of $50. The bond's par value is $1,000. Therefore, its coupon rate will be 5% ($50 / $1,000 x 100). What are the uses of Coupon Rates? Almost every bond that investors may obtain will have a coupon payment.

Coupon rate of bond

Coupon Rate Definition - investopedia.com The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond. Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

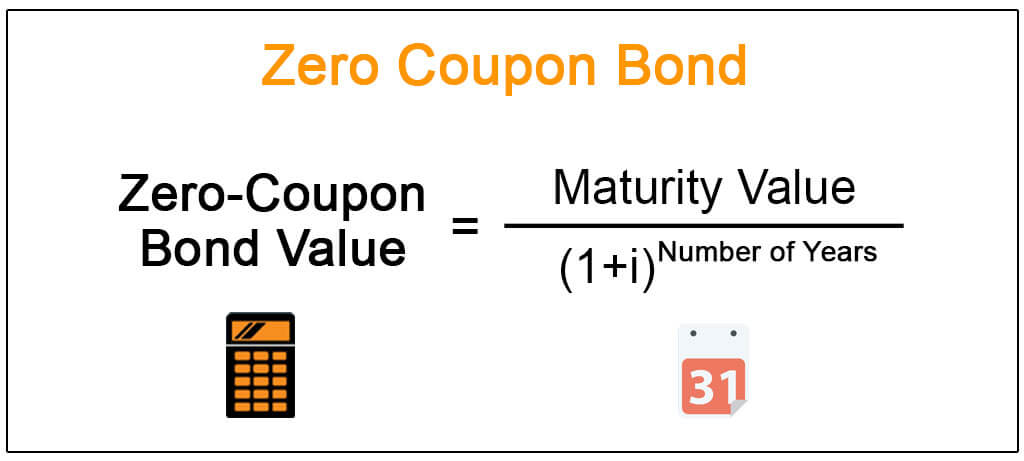

Coupon rate of bond. Coupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following: What Is a Coupon Rate? And How Does It Affects the Price ... A zero-coupon bond is a bond without coupons, and its coupon rate is 0%. The issuer of zero-coupon bonds only pays the face value of bonds at the maturity date. Instead of paying coupon interest, the bond issuer issues the bonds at price less than the face value. The discount of issue effectively represents the interest and yield for investors ... Fixing of coupon rates - Nykredit Realkredit A/S | User Walls To Nasdaq Copenhagen 27 April 2022 FIXING OF COUPON RATES Fixing of coupon rates effective from 29 April 2022 Effective from 29 April 2022, the coupon rates... Calculation of the Value of Bonds (With Formula) Coupon Rates: Coupon rate means the interest rate of the bond. The bond holder receives an annual rate of interest. Sometimes this rate of interest is also given half yearly. Maturity Period: Bonds in India are of recent origin. They have a normal maturity period of 10 years.

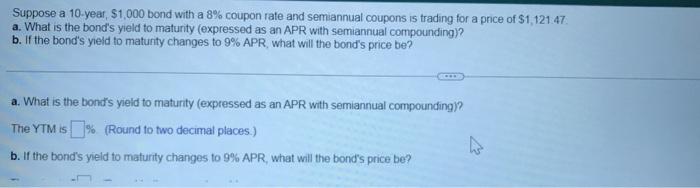

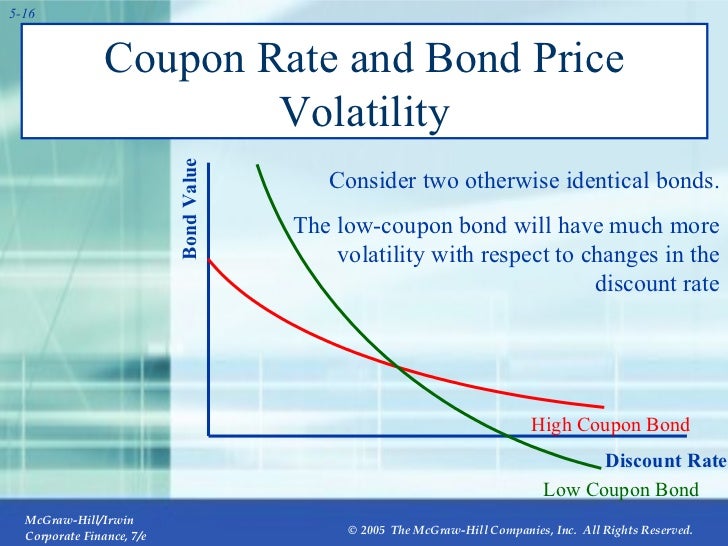

Bond Coupon Interest Rate: How It Affects Price A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... Coupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more " refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the principal amount when the bond matures. read more. In other words, it is the stated rate of interest paid on fixed income securities, primarily ... Bond Yield Calculator - Compute the Current Yield Bond Yield Calculator - Compute the Current Yield. On this page is a bond yield calculator to calculate the current yield of a bond. Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield. The tool will also compute yield to maturity, but see the YTM calculator for a ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Difference Between Coupon Rate and Interest Rate (With ... The coupon rate is normally used in the bonds, which is an income to the holder after paying the rate on certain purchased items. Interest rate is a reduction to the borrower by paying back the amount he/she has borrowed. The coupon Rate ends according to the maturity period mentioned by the bondholder while issuing the bond. What Is Coupon Rate and How Do You Calculate It? Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100. $100 / $1,000 = 0.10. The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Coupon Bond Formula | How to Calculate the Price of Coupon ... Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as, United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. Skip to content. Markets ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 102.84- ...

maturity debt funds: Constant maturity debt funds gain in ... When bond yields rise, bond prices fall and the reverse too is true. This is termed interest rate risk. When the duration of a bond's portfolio - a measure of the bond's interest rate risk calculated using maturity, coupon and current yield - is high, the interest rate risk is also high, and vice versa.

Coupon Rate Structure of Bonds - Valuation Academy 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40) each year for 6 years and the par value ($1000) at the end of 6 years.

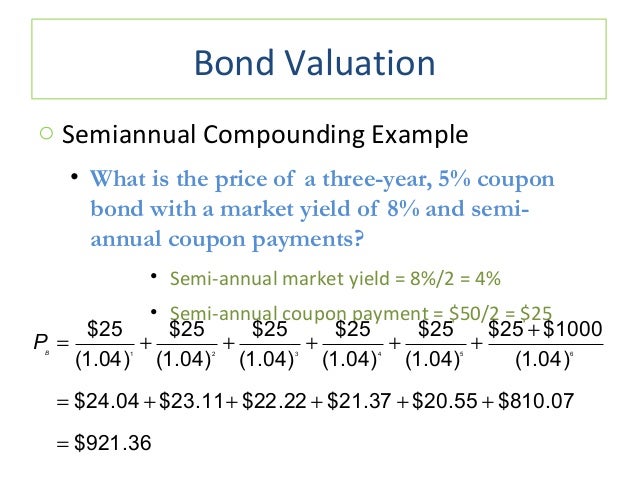

Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value

Coupon Rate - Meaning, Example, Types | Yield to Maturity ... Thus the coupon would be-. Coupon = 0.09 X 500.00 = USD 45.00. This means that bondholders of this bond will get USD 45.00 every year up until 2024 i.e. year of maturity. The tricky thing is the coupon rate of a bond also affects the price of the bonds in the secondary market. The bonds price is sensitive to the coupon rate.

Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

Difference Between Coupon Rate And Yield Of Maturity A coupon rate is a rate at which the interest payment of a bond is made to the investor. It represents the yearly interest rate paid by the bond with respect to its face value denoted as a percentage. The coupon rate is like fixed income security for governments in which the issuer of the bond receives the annual interest payments.

Coupon (finance) - Wikipedia Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year.

Bond Ratings Explained – Interpreting The Bond Rating System | Credit rating agency, Investing ...

Coupon Bond Formula | Examples with Excel Template The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. As per the current market trend, the bonds with similar risk profile have yielded to maturity of 6%. Calculate the market price of the bonds based on the given information. Solution:

Coupon Bond - Guide, Examples, How Coupon Bonds Work Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. , which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment.

What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Bond Returns: A 15-year, $1,000 par value bond has an 8.5% annual payment coupon. The bond ...

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond.

Explain Bonds, Bond Terms, Price and Yield, Types of Bond Risk - Arbor Asset Allocation Model ...

Coupon Rate Definition - investopedia.com The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Post a Comment for "43 coupon rate of bond"